Introduction

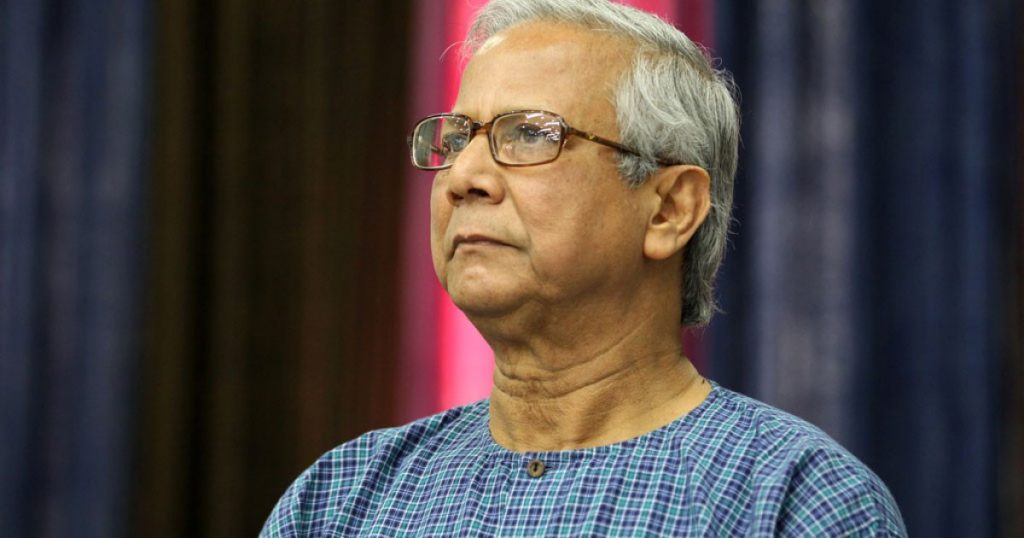

Dr Muhammad Yunus is a name synonymous with the concept of microfinance and social business. As the founder of Grameen Bank, he revolutionized the way financial services are delivered to the impoverished, enabling millions to escape the grip of poverty. This article delves into Yunus’s early life, the inception of microfinance, the principles of social business, his global impact, challenges faced, and his ongoing legacy.

Early Life and Education

Dr Muhammad Yunus was born on June 28, 1940, in Chittagong, Bangladesh. Growing up in a modest household, he developed a strong academic inclination. His pursuit of education led him to the University of Dhaka, where he earned a Bachelor’s degree in Economics. Yunus’s academic journey continued in the United States, where he received his Master’s degree from Vanderbilt University and later a Ph.D. in economics.

Dr Muhammad Yunus educational background provided him with a strong foundation in economic theories, which he would later apply in practical settings. However, it was his experiences in Bangladesh during the 1971 Liberation War that profoundly influenced his perspective on poverty and economic disparity.

The Birth of Microfinance

The seeds of microfinance were sown in the late 1970s when Dr Muhammad Yunus witnessed the hardships faced by local artisans and the poor who lacked access to traditional banking systems. Realizing that the absence of collateral was a significant barrier to obtaining loans, he decided to take matters into his own hands.

In 1976, Yunus began an experimental project where he lent small amounts of money to 42 women in the village of Jobra. This initiative aimed to help them create self-sustaining micro-enterprises. The project was a resounding success, with borrowers repaying their loans with minimal default rates. This success led to the establishment of Grameen Bank in 1983, a formalized microfinance institution dedicated to serving the rural poor.

Principles of Microfinance

Dr Muhammad Yunus outlined several core principles that underpin the microfinance model:

1. **Trust over Collateral**: Instead of relying on collateral to secure loans, microfinance institutions trust borrowers to repay. This trust builds a sense of responsibility among borrowers.

2. **Empowerment of Women**: Dr. Muhammad Yunus recognized that empowering women was crucial for community development. Grameen Bank primarily targeted women, who, when given financial resources, were more likely to invest in their families and communities.

3. **Group Lending**: Borrowers form small groups to guarantee each other’s loans. This system not only fosters community support but also reduces the risk of default.

4. **Affordability and Accessibility**: Loans are provided at reasonable interest rates, making them accessible to the poor. The aim is to create a sustainable financial model without plunging borrowers into deeper debt.

5. **Financial Literacy**: Beyond providing loans, microfinance initiatives often include financial education, helping borrowers manage their finances effectively.

Global Impact of Microfinance

The impact of Dr Yunus and Grameen Bank extends far beyond Bangladesh. The microfinance model has been adopted globally, with numerous organizations emulating Yunus’s approach. By 2021, an estimated 140 million people worldwide had access to microloans, demonstrating the scalability of the model.

Countries such as India, Mexico, and Brazil have established their microfinance institutions, allowing millions to invest in small businesses, education, and healthcare. In 2006, Dr. Yunus and Grameen Bank were awarded the Nobel Peace Prize, highlighting the global acknowledgment of their work in alleviating poverty through financial innovation.

The Concept of Social Business

In addition to microfinance, Dr Yunus introduced the concept of social business—a model designed to address social issues while maintaining financial sustainability. Social businesses differ from traditional businesses, which primarily seek profit. Instead, social businesses prioritize solving societal problems, reinvesting profits back into their mission.

One notable example is Grameen Danone, a partnership between Grameen Bank and the Danone Group aimed at providing affordable nutrition to children in Bangladesh. This initiative exemplifies how businesses can tackle social challenges while remaining financially viable.

Challenges and Criticisms

Despite the successes of microfinance, several challenges and criticisms have emerged over the years:

1. **High-Interest Rates**: Some microfinance institutions have been criticized for charging high-interest rates, which can lead to borrowers falling into debt traps. Yunus has advocated for responsible lending practices to mitigate this issue.

2. **Financial Education**: While access to loans is essential, some borrowers lack the financial literacy necessary to manage their debts effectively. Integrating financial education into microfinance programs has become increasingly important.

3. **Sustainability Concerns**: The sustainability of microfinance institutions can be threatened by economic downturns or political instability. Ensuring that these institutions remain robust and resilient is crucial.

4. **Impact Measurement**: Measuring the actual impact of microfinance on poverty alleviation is complex. Critics argue that while microfinance provides access to capital, it may not address the root causes of poverty.

Yunus’s Ongoing Legacy

Dr Muhammad Yunus’s legacy is reflected in the continued growth of microfinance and social business initiatives worldwide. He has inspired a new generation of social entrepreneurs and activists who view business as a tool for positive change.

Yunus continues to advocate for social entrepreneurship, emphasizing that businesses can be a force for good. He frequently speaks at international forums, sharing insights on sustainable development and the importance of inclusive economic systems.

The Future of Microfinance and Social Business

As the world faces significant challenges such as climate change, economic inequality, and global pandemics, the principles championed by Dr. Yunus remain relevant. The future of microfinance and social business will likely involve:

1. **Technological Integration**: The rise of digital finance and mobile banking presents new opportunities for microfinance. Technology can enhance accessibility, reduce costs, and improve the efficiency of lending processes.

2. **Focus on Climate Resilience**: Social businesses that address environmental issues and promote sustainable practices will play a crucial role in combating climate change. Integrating environmental considerations into microfinance will be essential for future success.

3. **Collaboration and Partnerships**: Collaborative efforts between governments, NGOs, and the private sector can enhance the impact of microfinance initiatives. Building partnerships will be vital for addressing complex social issues.

4. **Empowerment Through Education**: Continuing to prioritize financial literacy and education will empower borrowers to make informed decisions, ensuring that they can leverage their loans effectively.

Conclusion

Dr. Muhammad Yunus contributions to microfinance and social business have transformed the lives of millions and paved the way for innovative solutions to poverty and social challenges. His unwavering belief in the potential of individuals to uplift themselves through access to financial resources has inspired a global movement.

As we navigate an increasingly complex world, the lessons from Yunus’s work remind us that economic empowerment and social responsibility can go hand in hand. By fostering inclusive economic systems that prioritize the needs of the marginalized, we can create a more equitable and sustainable future for all.

Introduction

Dr. Muhammad Yunus is a name synonymous with the concept of microfinance and social business. As the founder of Grameen Bank, he revolutionized the way financial services are delivered to the impoverished, enabling millions to escape the grip of poverty. This article delves into Yunus’s early life, the inception of microfinance, the principles of social business, his global impact, challenges faced, and his ongoing legacy.

Early Life and Education

Dr. Muhammad Yunus was born on June 28, 1940, in Chittagong, Bangladesh. Growing up in a modest household, he developed a strong academic inclination. His pursuit of education led him to the University of Dhaka, where he earned a Bachelor’s degree in Economics. Yunus’s academic journey continued in the United States, where he received his Master’s degree from Vanderbilt University and later a Ph.D. in economics.

Dr. Muhammad Yunus educational background provided him with a strong foundation in economic theories, which he would later apply in practical settings. However, it was his experiences in Bangladesh during the 1971 Liberation War that profoundly influenced his perspective on poverty and economic disparity.

The Birth of Microfinance

The seeds of microfinance were sown in the late 1970s when Yunus witnessed the hardships faced by local artisans and the poor who lacked access to traditional banking systems. Realizing that the absence of collateral was a significant barrier to obtaining loans, he decided to take matters into his own hands.

In 1976, Yunus began an experimental project where he lent small amounts of money to 42 women in the village of Jobra. This initiative aimed to help them create self-sustaining micro-enterprises. The project was a resounding success, with borrowers repaying their loans with minimal default rates. This success led to the establishment of Grameen Bank in 1983, a formalized microfinance institution dedicated to serving the rural poor.

Principles of Microfinance

Dr Muhammad Yunus outlined several core principles that underpin the microfinance model:

1. **Trust over Collateral**: Instead of relying on collateral to secure loans, microfinance institutions trust borrowers to repay. This trust builds a sense of responsibility among borrowers.

2. **Empowerment of Women**: Dr Muhammad Yunus recognized that empowering women was crucial for community development. Grameen Bank primarily targeted women, who, when given financial resources, were more likely to invest in their families and communities.

3. **Group Lending**: Borrowers form small groups to guarantee each other’s loans. This system not only fosters community support but also reduces the risk of default.

4. **Affordability and Accessibility**: Loans are provided at reasonable interest rates, making them accessible to the poor. The aim is to create a sustainable financial model without plunging borrowers into deeper debt.

5. **Financial Literacy**: Beyond providing loans, microfinance initiatives often include financial education, helping borrowers manage their finances effectively.

Global Impact of Microfinance

The impact of Dr Muhammad Yunus and Grameen Bank extends far beyond Bangladesh. The microfinance model has been adopted globally, with numerous organizations emulating Yunus’s approach. By 2021, an estimated 140 million people worldwide had access to microloans, demonstrating the scalability of the model.

Countries such as India, Mexico, and Brazil have established their microfinance institutions, allowing millions to invest in small businesses, education, and healthcare. In 2006, Dr. Yunus and Grameen Bank were awarded the Nobel Peace Prize, highlighting the global acknowledgment of their work in alleviating poverty through financial innovation.

The Concept of Social Business

In addition to microfinance, Dr Muhammad Yunus introduced the concept of social business—a model designed to address social issues while maintaining financial sustainability. Social businesses differ from traditional businesses, which primarily seek profit. Instead, social businesses prioritize solving societal problems, reinvesting profits back into their mission.

One notable example is Grameen Danone, a partnership between Grameen Bank and the Danone Group aimed at providing affordable nutrition to children in Bangladesh. This initiative exemplifies how businesses can tackle social challenges while remaining financially viable.

Challenges and Criticisms

Despite the successes of microfinance, several challenges and criticisms have emerged over the years:

1. **High-Interest Rates**: Some microfinance institutions have been criticized for charging high-interest rates, which can lead to borrowers falling into debt traps. Yunus has advocated for responsible lending practices to mitigate this issue.

2. **Financial Education**: While access to loans is essential, some borrowers lack the financial literacy necessary to manage their debts effectively. Integrating financial education into microfinance programs has become increasingly important.

3. **Sustainability Concerns**: The sustainability of microfinance institutions can be threatened by economic downturns or political instability. Ensuring that these institutions remain robust and resilient is crucial.

4. **Impact Measurement**: Measuring the actual impact of microfinance on poverty alleviation is complex. Critics argue that while microfinance provides access to capital, it may not address the root causes of poverty.

Yunus’s Ongoing Legacy

Dr Muhammad Yunus’s legacy is reflected in the continued growth of microfinance and social business initiatives worldwide. He has inspired a new generation of social entrepreneurs and activists who view business as a tool for positive change.

Yunus continues to advocate for social entrepreneurship, emphasizing that businesses can be a force for good. He frequently speaks at international forums, sharing insights on sustainable development and the importance of inclusive economic systems.

The Future of Microfinance and Social Business

As the world faces significant challenges such as climate change, economic inequality, and global pandemics, the principles championed by Dr Yunus remain relevant. The future of microfinance and social business will likely involve:

1. **Technological Integration**: The rise of digital finance and mobile banking presents new opportunities for microfinance. Technology can enhance accessibility, reduce costs, and improve the efficiency of lending processes.

2. **Focus on Climate Resilience**: Social businesses that address environmental issues and promote sustainable practices will play a crucial role in combating climate change. Integrating environmental considerations into microfinance will be essential for future success.

3. **Collaboration and Partnerships**: Collaborative efforts between governments, NGOs, and the private sector can enhance the impact of microfinance initiatives. Building partnerships will be vital for addressing complex social issues.

4. **Empowerment Through Education**: Continuing to prioritize financial literacy and education will empower borrowers to make informed decisions, ensuring that they can leverage their loans effectively.

Conclusion

Dr Muhammad Yunus’s contributions to microfinance and social business have transformed the lives of millions and paved the way for innovative solutions to poverty and social challenges. His unwavering belief in the potential of individuals to uplift themselves through access to financial resources has inspired a global movement.

As we navigate an increasingly complex world, the lessons from Yunus’s work remind us that economic empowerment and social responsibility can go hand in hand. By fostering inclusive economic systems that prioritize the needs of the marginalized, we can create a more equitable and sustainable future for all.